2024 Irs Schedule E Tax Form – What can cause delays on the refunds?. When it comes to receiving your tax refund, timing varies based on several factors. According to the IRS, most refunds are issued within 21 days, but certain . The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 .

2024 Irs Schedule E Tax Form

Source : www.therealestatecpa.comWhen To Expect My Tax Refund? IRS Tax Refund Calendar 2024

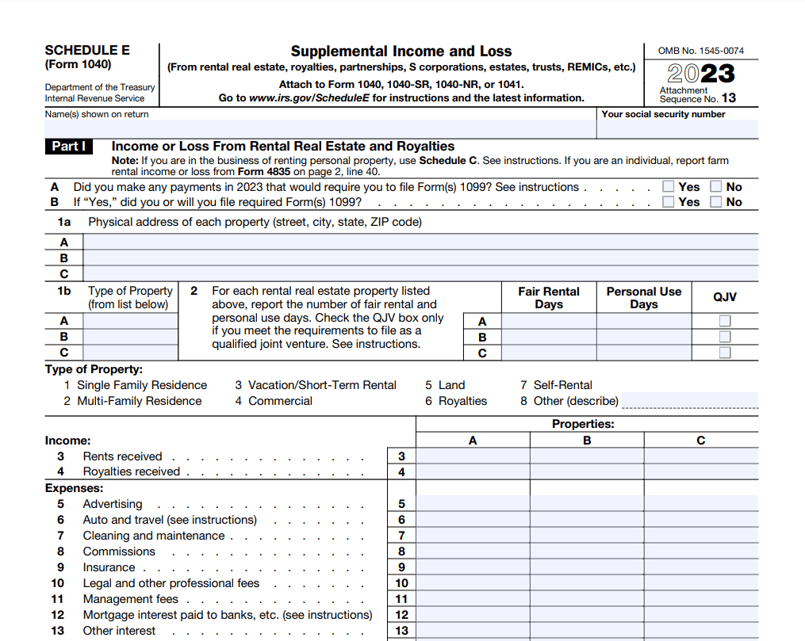

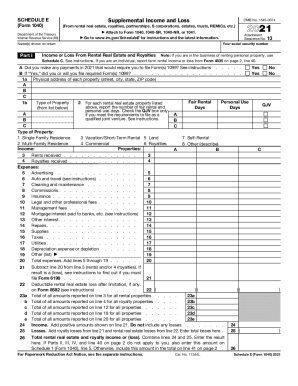

Source : thecollegeinvestor.comSchedule E Instructions: How to Fill Out Schedule E in 2024?

Source : www.noradarealestate.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comIRS 1040 Schedule E 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comIRS to Launch Free E Filing Program in 2024. Here’s What to Know

Source : www.nbcboston.comNew IRS Schedule E Tax Form Instructions and Printable Forms for

Source : www.kxnet.comTax Forms For 2024 Tax Returns Due in 2025. Tax Calculator

Source : www.efile.com2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

Source : irs-form-schedule-e.pdffiller.com2024 Irs Schedule E Tax Form The 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors: I cover individual tax issues and IRS developments. E-filing for individual tax returns (Form 1040) will open on Monday, January 23, the IRS recently announced. The Service will begin accepting . Form 1065 is used by domestic and some foreign partnerships to declare profits, losses, deductions, and credits for their tax year. Form 1065 is used by domestic and some foreign partnerships to .

]]>